Friendswood title loans provide a quick, flexible financial solution by using personal assets (primarily vehicles) as collateral. With lenient requirements, faster approval times, and customizable repayment options, these loans cater to diverse needs. However, borrowers must be aware of the risk of asset forfeiture if loan agreements aren't met. The process involves gathering essential documents, connecting with a licensed lender, assessing vehicle value, determining loan terms, and placing a lien on the vehicle title. This method offers minimal barriers to entry and accessible no-credit-check funding solutions.

Considering Friendswood title loans? This comprehensive guide offers essential advice for unlocking access to capital through your vehicle. Learn about the benefits and considerations of borrowing against your asset, and discover what to expect during the application process. Whether you’re a first-time borrower or experienced, this article navigates the ins and outs of Friendswood title loans, empowering you to make informed decisions.

- Understanding Friendswood Title Loans: Unlocking Access to Capital

- Benefits and Considerations for Borrowing Against Your Asset

- Navigating the Process: What to Expect When Applying for a Title Loan in Friendswood

Understanding Friendswood Title Loans: Unlocking Access to Capital

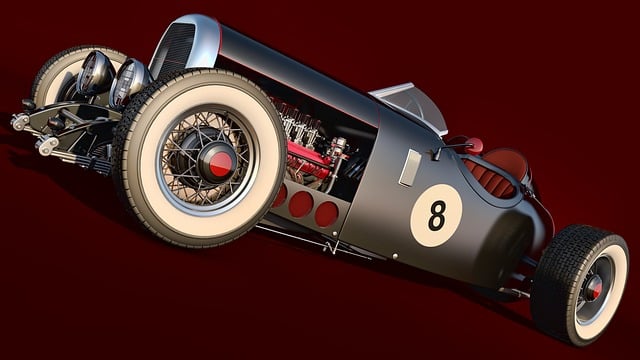

Friendswood title loans offer a unique financial solution for individuals seeking quick access to capital. This type of loan utilizes the value embedded in an asset, commonly a vehicle, as collateral. By leveraging this equity, borrowers can unlock substantial funds, providing them with a safety net during unforeseen circumstances or opportunities that require immediate funding.

One of the key advantages of Friendswood title loans is their flexibility. Unlike traditional bank loans, these loans offer more lenient requirements and faster approval times. Borrowers often have the option for flexible payments, tailored to suit individual financial capabilities. Additionally, loan terms can be negotiated, providing a level of customization that aligns with repayment comfort levels. This accessibility has made boat title loans in Friendswood a viable option for those needing funds for various purposes, from boating enthusiasts looking to upgrade their vessels to individuals facing medical emergencies.

Benefits and Considerations for Borrowing Against Your Asset

When considering Friendswood title loans, understanding the benefits and considerations can help you make an informed decision. One significant advantage is that these loans offer a quick and accessible way to obtain funding by using your asset as collateral. This means you can leverage the value of your vehicle or other valuable property to secure a loan with potentially lower interest rates compared to traditional unsecured loans. Additionally, Friendswood title loans provide flexibility in terms of repayment schedules, allowing borrowers to structure payments that fit their financial comfort zones.

However, it’s crucial to consider the potential risks associated with such loans. Unlike semi-truck loans or other asset-backed financing options, Friendswood title loans can result in the loss of your collateral if you fail to repay the loan as agreed. This is a significant consideration, especially for borrowers who rely heavily on their assets for livelihood. Loan payoff plans should be carefully evaluated, ensuring that the terms align with your financial capabilities to avoid default and potential repossession.

Navigating the Process: What to Expect When Applying for a Title Loan in Friendswood

Navigating the process of applying for a Friendswood title loan involves understanding several key steps. First, borrowers will need to gather necessary documents such as their vehicle’s registration and proof of insurance. This ensures that all details related to the car are in order and accessible. Next, they’ll visit or contact a licensed lender offering Friendswood title loans, which can be found both online and offline. Lenders will review the borrower’s information, assess the value of their vehicle, and determine loan terms, including interest rates and repayment periods. This evaluation is typically quick, especially when using modern digital platforms that streamline the process.

A unique aspect of Friendswood title loans is the collateral requirement—the lender places a lien on your vehicle title during the loan period. This acts as security for the fast cash you receive. Unlike traditional loans that often involve extensive paperwork and credit checks, these loans offer an alternative with minimal barriers to entry. Borrowers can expect a straightforward application process without needing excellent credit, making it accessible to many individuals seeking no-credit-check funding solutions.

When considering Friendswood title loans, understanding the process and its benefits is crucial. By borrowing against your asset, you gain access to immediate capital with flexible terms. However, it’s essential to weigh the considerations and navigate the application meticulously. Familiarizing yourself with each step ensures a smooth experience, providing a reliable solution for your financial needs in Friendswood title loans.