Friendswood title loans provide quick cash for emergencies using vehicle titles as collateral. Cost and fees vary based on loan terms, vehicle valuation, digital processing, application charges, documentation, interest rates, and repayment options. Transparency is key to empowering borrowers with informed financial choices.

“Unraveling the complexities of Friendswood title loans is essential for anyone considering this unique financial option. This article guides you through the intricate world of these loans, starting with a basic understanding—what exactly are Friendswood title loans? We’ll delve into the fee structure, exploring how costs are calculated and what common expenses one can expect. By the end, readers will have a comprehensive view of the potential financial implications.”

- What Are Friendswood Title Loans?

- How Are Fees Calculated for These Loans?

- Exploring Common Costs and Charges

What Are Friendswood Title Loans?

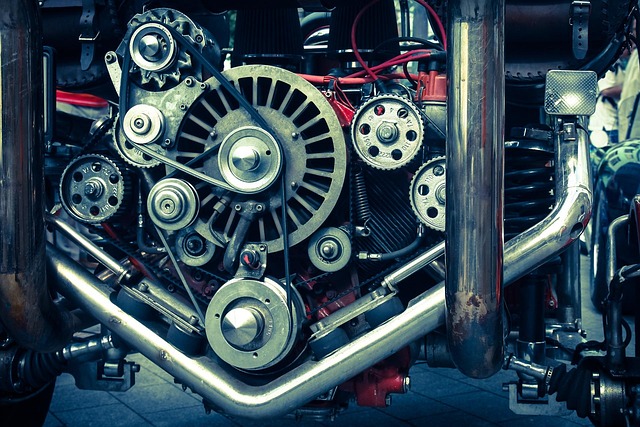

Friendswood title loans are a type of secured lending option designed to provide individuals with quick access to cash using their vehicle’s title as collateral. This alternative financing method is particularly useful for those in need of emergency funding or seeking more flexible payment plans compared to traditional bank loans. By pledging your vehicle, you can gain approval for a loan amount based on its market value, allowing you to keep your vehicle while accessing the needed funds.

This type of loan is ideal for unexpected expenses, offering a convenient solution without strict credit requirements. The process typically involves a simple application, quick funding, and manageable repayment terms tailored to the borrower’s needs. Whether it’s for unforeseen medical bills, home repairs, or any other urgent financial need, Friendswood title loans provide a viable option, ensuring you have access to emergency funding when traditional methods may not be readily available.

How Are Fees Calculated for These Loans?

The fees associated with Friendswood title loans are calculated based on several key factors, ensuring a comprehensive assessment of the loan applicant’s financial situation and the value of their asset—typically their vehicle. Lenders consider the loan terms, including the amount borrowed and the repayment period, to determine interest rates. This process is essential in setting fair and transparent pricing for borrowers.

Additionally, the vehicle valuation plays a pivotal role in fee calculation. The lender will appraise your vehicle to ascertain its current market value, which directly influences the loan-to-value ratio. This ratio, in turn, affects the overall fees and interest charged on the Friendswood title loan. Efficient title transfer processes, facilitated by digital systems, can also contribute to reduced fees by streamlining the paperwork and administrative tasks involved.

Exploring Common Costs and Charges

When considering Friendswood title loans, it’s crucial to demystify the various costs and charges involved. These transactions often come with a range of fees that can significantly impact your overall financial commitment. Common expenses include application fees, appraisal costs, documentation charges, and, of course, interest rates. Understanding these components is essential for making an informed decision about whether a car title loan aligns with your financial goals.

The repayment options available under Friendswood title loans also factor into the total cost. Different lenders may offer flexible repayment periods or accelerated payoff schedules, each affecting the overall fees. Additionally, understanding loan requirements, such as minimum credit scores and vehicle value criteria, can help borrowers anticipate potential charges. By being transparent about these aspects, Friendswood title loans can provide a clearer picture of what to expect, empowering borrowers to make responsible financial choices.

Friendswood title loans offer a unique financing option, but understanding the associated fees is paramount. By grasping how these charges are calculated and exploring common costs, borrowers can make informed decisions. This knowledge equips individuals to navigate the process confidently, ensuring they secure the best terms for their specific needs in the Friendswood title loan market.